Aave V4 Introduces Risk Premiums to Match Borrowing Rates with Collateral Risk

Source: aave.com

Aave V4 introduces a major update called Risk Premiums aimed at improving how borrowing rates reflect the real risk of collateral assets. This change addresses a long-standing issue in DeFi lending, where interest rates often don’t match the actual risk associated with borrowers' collateral.

What’s the Problem with Aave V3?

In traditional lending, interest rates differ based on the borrower’s credit risk-those who are less risky pay lower rates and vice versa. However, Aave V3 uses uniform borrowing rates per market, meaning all borrowers pay the same interest regardless of the actual risk of their collateral.

For example, borrowing USDC against ETH collateral comes with the same rate as borrowing USDC backed by a riskier token. This simplicity leads to users with safer collateral subsidizing riskier borrowers, limits the range of collateral types, and causes instability in rates and liquidity when risky assets are added.

How Risk Premiums Work in Aave V4

Aave V4 fixes this by introducing Risk Premiums, where borrowing costs adjust according to the risk level of the collateral you provide.

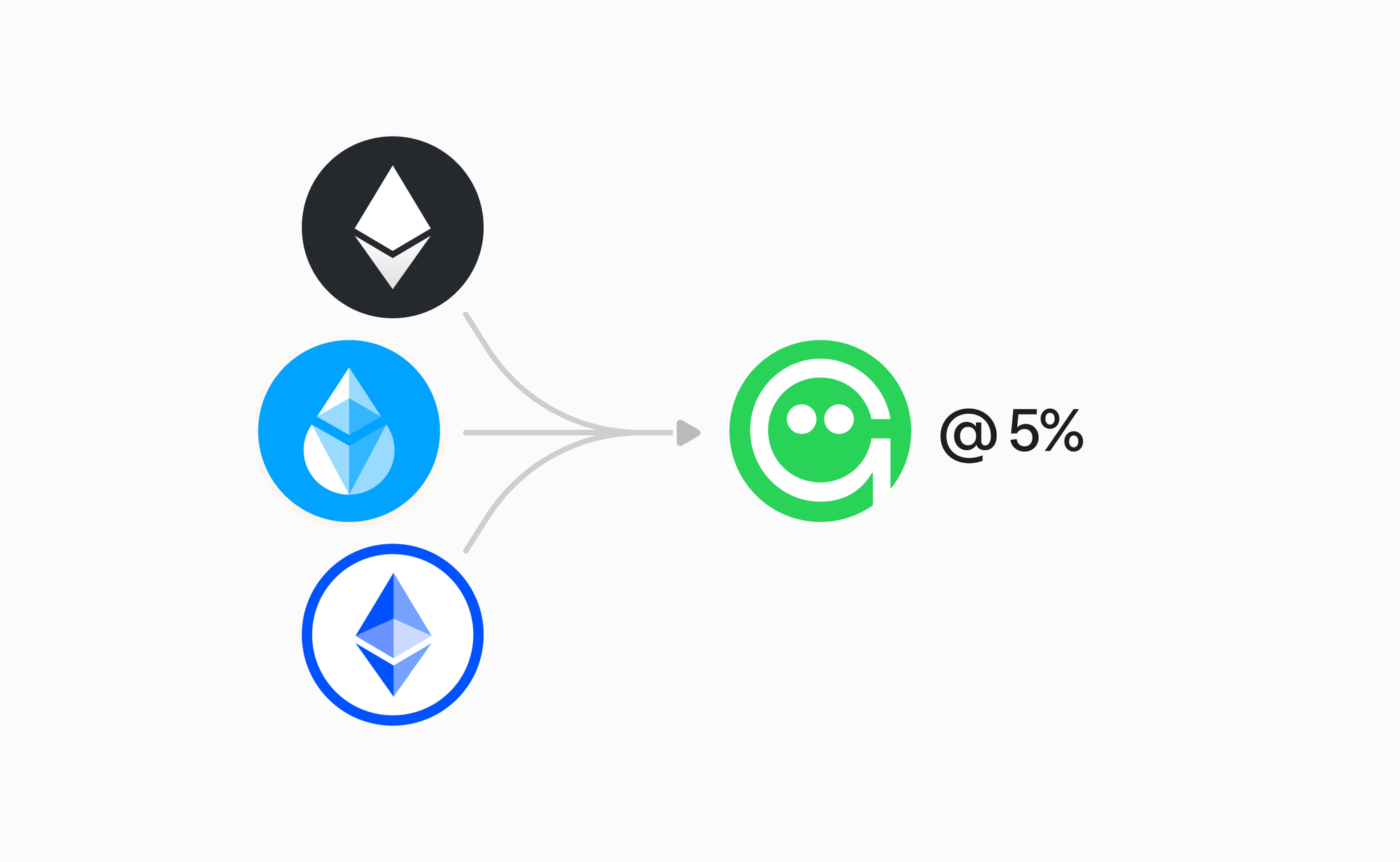

- The system starts with a base borrowing rate per asset, influenced by supply and demand (similar to V3).

- Users offering high-quality collateral (e.g., ETH) pay only this base rate.

- Borrowers using riskier collateral pay a premium-an added charge proportional to how risky the collateral is.

Example:

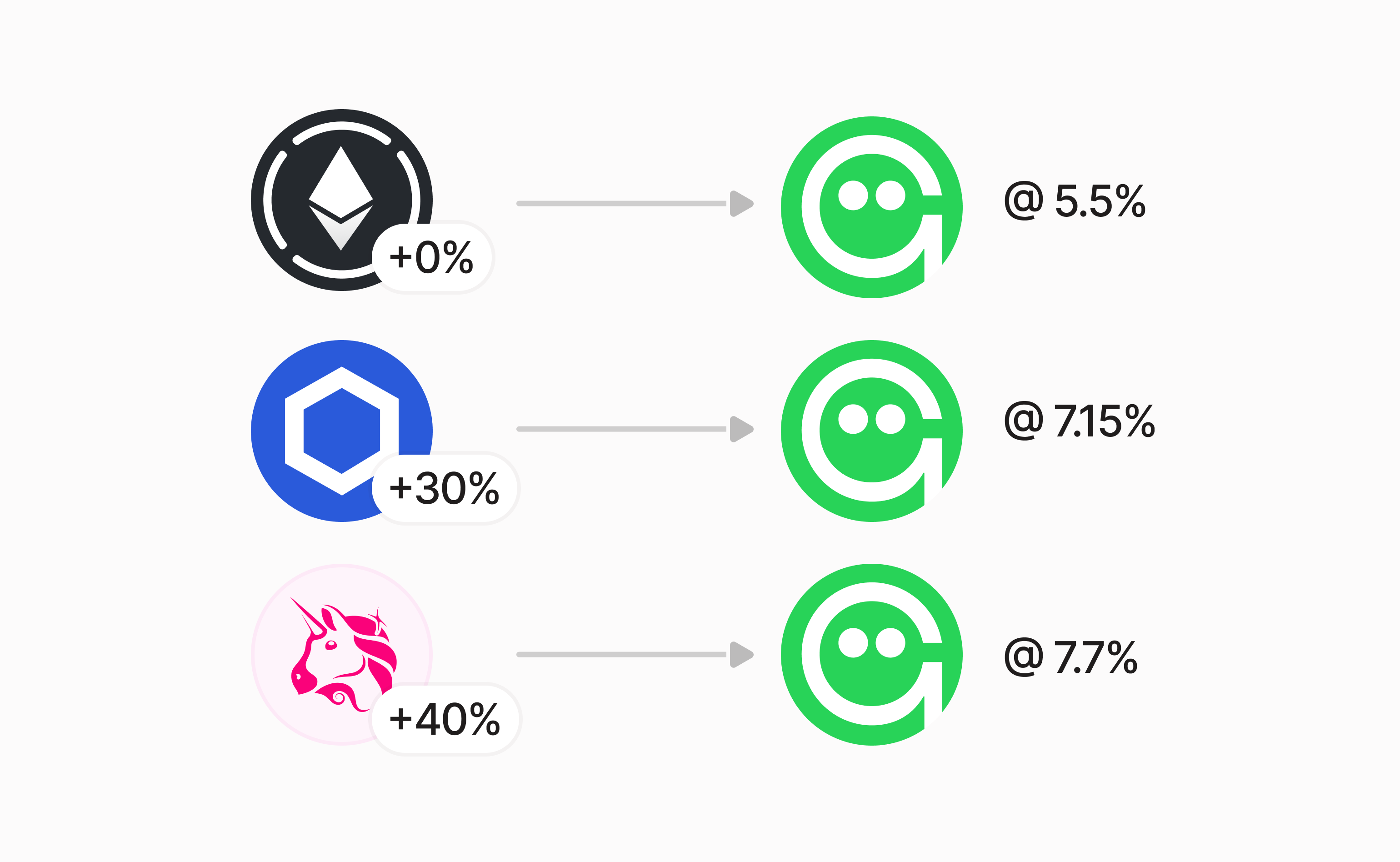

- Base rate for borrowing GHO: 5%

- Using WETH (0% Collateral Risk) → Pay 5% total.

- Using LINK (30% Collateral Risk) → Pay 5% base + 30% premium on the accumulated debt.

- Using UNI (40% Collateral Risk) → Pay 5% base + 40% premium.

This creates a tiered borrowing rate system that better aligns rates with actual risk.

The Three Tiers of Risk Premiums

Risk Premiums apply on three levels to ensure comprehensive risk management:

- Asset Liquidity Premiums: Each listed collateral asset is assigned a risk score (0% to 1000%). High-quality assets like ETH have low scores; newer or volatile tokens get higher ones. These scores are adjustable via governance.

- User Risk Premiums: Reflect the borrower’s overall risk based on the mix and amount of different collaterals they hold. It's a weighted average of the Asset Liquidity Premiums from the borrower's portfolio.

- Spoke Risk Premiums: Calculated per “Spoke” (submarket or pool within Aave V4), representing the average user risk in that Spoke. This allows customization based on user behavior and asset types within each Spoke.

Risk Premiums by Spokes: Customizing Risk

Aave V4 supports different Spokes to cater to various asset types and risk profiles:

- EMode Spokes: Focus on assets with correlated price behavior (e.g., liquid staking tokens). Safer tokens like stETH have the lowest premiums, while newer or riskier assets have higher premiums.

- RWA (Real-World Asset) Spokes: Handle tokenized off-chain assets like treasury bills. These receive premiums tailored to their stability and liquidity, allowing each Spoke to fine-tune risk management.

This structure provides flexibility while maintaining a shared liquidity pool.

Why Risk Premiums Matter

Risk Premiums bring several benefits to the Aave ecosystem:

- Better rates for safer collateral: Borrowers with strong collateral enjoy lower borrowing costs.

- Fair risk pricing: Riskier collaterals pay premiums that reflect their actual risk, balancing the system.

- Supports diverse assets: Enables onboarding new and varied collateral types without destabilizing the protocol.

- Encourages quality collateral: Incentivizes users to provide high-quality assets to benefit from lower rates.

- Specialized markets: Allows customized risk models in different Spokes, encouraging innovation.

- Sustainable revenue for Aave DAO: Higher premiums translate into increased protocol fees, supporting long-term growth.

With Risk Premiums, Aave V4 offers a more precise, efficient, and fair borrowing environment, making the platform safer and more attractive to a broader range of users and assets.

Stay updated with more insights and developments by exploring Aave's official blog.