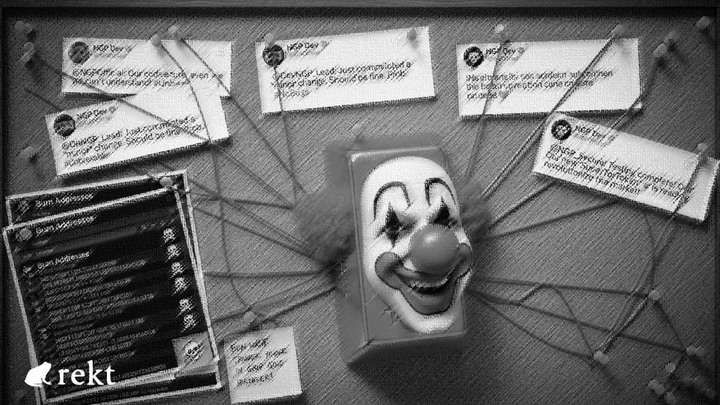

BTC Turk Loses $51.7M Again in Multi-Chain Hack — Same Mistakes, Twice

Source: REKT.News - BTC Turk REKT

BTC Turk, one of Turkey’s leading crypto exchanges, has fallen victim to a staggering $51.7 million hot wallet compromise just 14 months after a similar $55 million breach. This latest attack spread across seven different EVM-compatible blockchains-Ethereum, Avalanche, Arbitrum, Base, Optimism, Mantle, and Polygon-highlighting ongoing vulnerabilities in the exchange’s hot wallet security.

What Happened?

- Attackers gained access to private keys used to manage BTC Turk’s hot wallets.

- Stolen funds were systematically converted from a variety of altcoins into Ethereum using rapid MetaMask swaps.

- The breach affected wallets across multiple chains simultaneously, reflecting a highly coordinated and sophisticated operation.

- Despite BTC Turk’s attempts to halt withdrawals and freeze affected accounts, attackers continued moving funds smoothly across networks.

Key Details on the Breach

- $51.7 million drained in total.

- The hackers consolidated funds into just two major wallets before distributing portions further:

- $15.2M ETH and $800K USDT routed to one wallet

- $16.7M ETH moved to another

- $15.1M sent elsewhere in ETH

- Approximately 33 BTC (~$3.9M) also stolen

- Over 90 different token types were immediately swapped into ETH to maximize liquidity and obfuscation.

Repeating Past Mistakes: A Familiar Playbook

BTC Turk’s second major hack involving leaked private keys points to a repeated security failure. The first attack in June 2024 led to a $55 million hot wallet drain, yet the exchange didn’t sufficiently improve its key management practices.

- Both hacks show identical attack vectors: compromised private keys leading to rapid multi-chain fund drains.

- The current CEO, appointed after the 2024 breach, has remained silent with no substantial public communication or updates.

- Official statements describe "technical issues" with hot wallets, downplaying the severity of what’s effectively a catastrophic security failure.

Crisis Management: Silence and Minimal Transparency

BTC Turk has provided very limited information post-breach, opting instead for vague statements:

- Claims of cold wallets and customer funds being unaffected.

- Confirmation that authorities have been notified.

- No timelines or recovery plans have been disclosed.

- Customer deposits and withdrawals remain frozen indefinitely.

This communication strategy leaves users in the dark and fuels distrust just as the stolen funds remain active and traceable on public blockchains.

Context: Turkey’s Crypto Environment and Industry Challenges

- Turkey’s unstable currency environment drives many citizens toward cryptocurrencies, creating demand that exchanges struggle to secure properly.

- BTC Turk is not an isolated case. Previous crypto scandals, like the infamous collapse of Thodex in 2021 (with over $2 billion lost), show a pattern of weak operational security across Turkish exchanges.

- The continuous repetition of hacks caused by poor private key protection underlines systemic issues rather than isolated processes.

- Hot wallet compromises, once a dramatic headline, are now depressingly routine-exchanges scramble to respond but the attackers stay ahead.

Impact on the Broader Market

- BTC Turk’s latest loss pushes 2025’s total exchange hack losses in emerging markets close to $200 million.

- Other notable hacks, including $44 million at AscendEX and $27 million at BitMart, show a consistent pattern of large-scale breaches impacting smaller or less established platforms.

- Hot wallet vulnerabilities remain the primary target, especially in regions where security protocols lag behind massive crypto inflows.

Why Are These Hacks Still Happening?

- Lack of robust private key management and reliance on hot wallets.

- Slow adoption or improper implementation of multi-signature wallets and hardware security modules (HSMs).

- Poor operational security culture and insufficient staff training.

- Desperation in unstable economies leaves exchanges focused more on growth and liquidity than security.

Final Thoughts

BTC Turk’s repeat $50 million+ losses reveal deep flaws in Web3 operational security, especially in emerging markets. Exchanges keep making the same mistakes despite previous disasters, putting user funds at risk again and again.

- Multi-chain, multi-token hacks showcase how attackers are evolving faster than exchange defenses.

- Transparency remains minimal, eroding user trust.

- Until private key security receives the investment, attention, and expertise it demands, these devastating hacks will continue.