Crypto Wrench Attacks Push Investors Toward Safer Centralized Custody

Source: CoinTelegraph

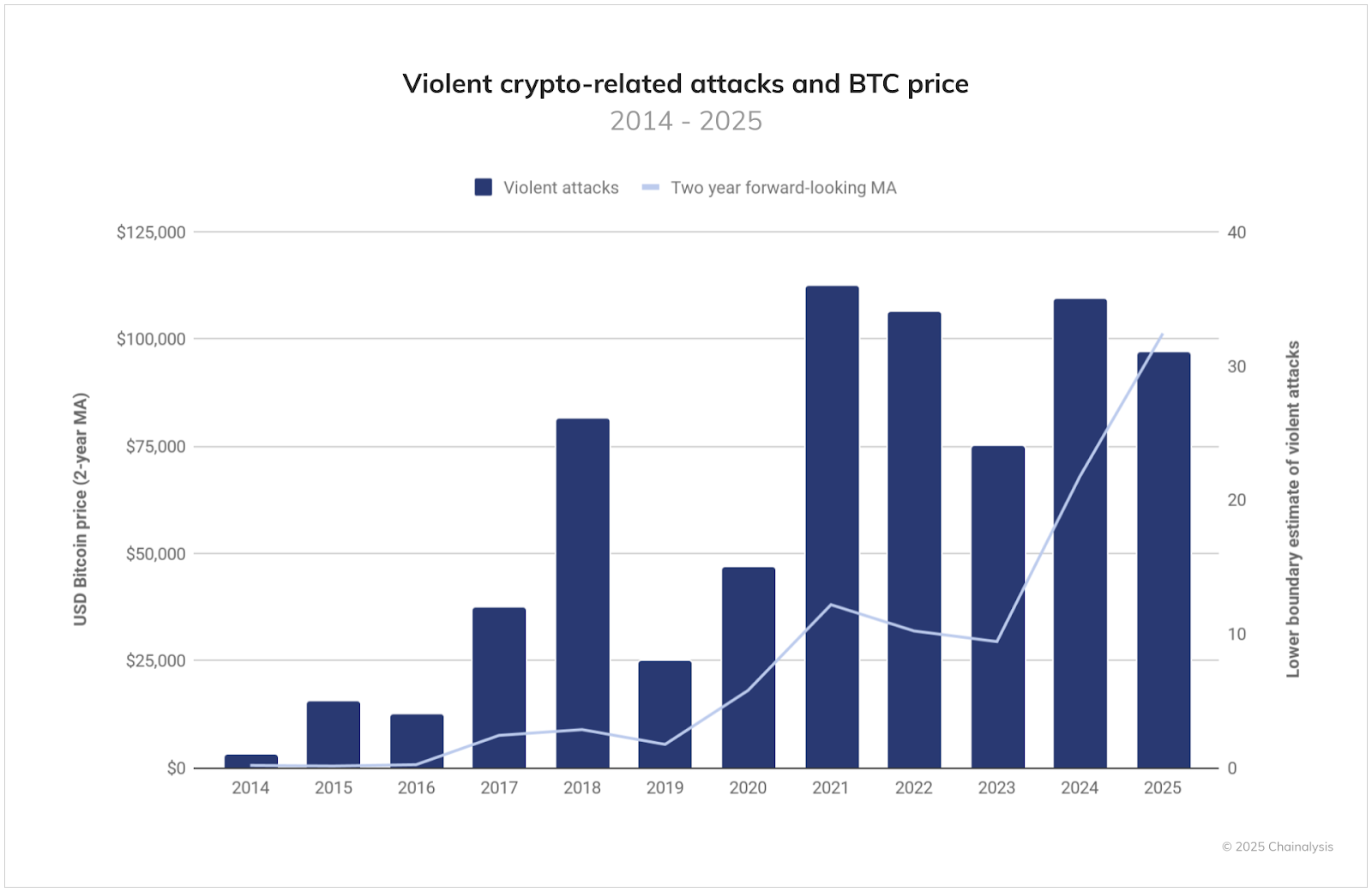

Crypto custodians are witnessing a surge in demand as physical threats against investors, known as "$5 wrench attacks," increase. These attacks involve coercing victims at gunpoint or through kidnapping to surrender crypto keys, targeting traders, founders, and executives in the blockchain space.

What Are Wrench Attacks?

- Wrench attacks are physical attempts to steal cryptocurrencies by forcing victims to reveal private keys or access to wallets.

- Since 2014, hundreds of such cases have been documented.

- Recently, high-profile incidents include the kidnapping of Ledger co-founder David Balland and his wife in early 2025, and an attempted abduction of an exchange founder’s daughter in Paris.

- These violent acts have alarmed governments; for example, the French Interior Minister held talks with crypto professionals to address rising security concerns.

The Growing Threat to Self-Custody Holders

Crypto’s core advice-“not your keys, not your coins”-is losing appeal among investors who fear for their personal safety. While cold wallets provide full asset control offline, they also present a single point of failure making owners vulnerable to physical attacks.

- Cold wallets have long been praised for security but can be compromised with force.

- As wealth in crypto rises, so does the incentive for physical theft.

Shift Toward Institutional Custody

Amid these threats, more investors are moving assets into regulated custodial services.

- Emma Shi from HashKey reports growing interest from high-net-worth individuals, family offices, and wealthy retail investors after incidents like the Manhattan kidnapping.

- Custody providers offer added security layers like time-locks and multi-step approvals, making theft more difficult and costly.

- Institutional custody transfers risk from individuals to professional teams, raising the effort and cost for attackers.

Limitations of Centralized Custody

While custodians reduce some risk, they introduce new vulnerabilities, including:

- Potential employee misconduct

- Possibility of phishing attacks or breaches, as seen with Coinbase and Bybit hacks

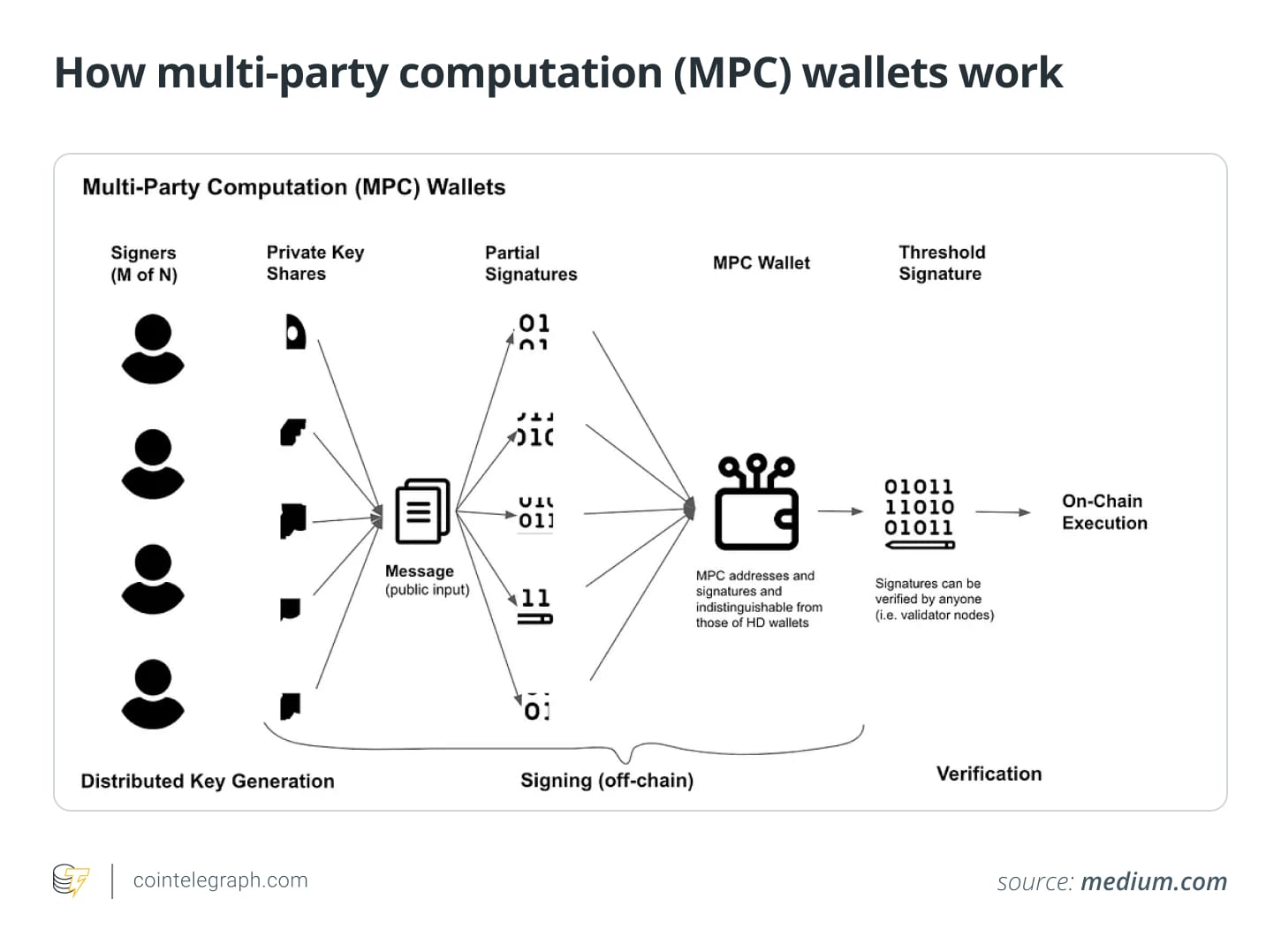

Multiparty Computation (MPC): A Middle Ground

Wade Wang, CEO of MPC service Safeheron, highlights MPC as a promising solution:

- MPC distributes control of assets among multiple parties rather than a single key holder.

- Funds transfers require consensus among several authorized parties, making wrench attacks far harder.

- This approach blends decentralization with institutional-grade security, aligning with blockchain's foundational principles.

The Role of Public Perception and Regulation

- Attackers often assume holders manage their own keys, so promoting awareness of custodial storage can help deter attacks.

- According to a 2024 Ernst & Young report, growing regulatory clarity in the EU and US is fostering institutional involvement and legitimizing custodial services.

- Regulations increase law enforcement actions, which raises the stakes against physical crypto thefts, further discouraging wrench attacks.

Looking Ahead: Security Beyond Custody

- While transitioning to custodianship alleviates some risks, executives are also investing more in personal security measures, such as hiring protection services.

- Industry experts view current wrench attacks as a temporary challenge as the crypto landscape matures toward greater safety standards-akin to those in traditional finance.

Key Takeaways:

- Wrench attacks pose a growing physical threat to crypto holders, especially high-net-worth individuals.

- This has triggered a major shift from self-custody toward institutional and distributed custody solutions.

- Multiparty computation (MPC) offers decentralized security that minimizes single points of failure.

- Regulatory developments and heightened law enforcement will likely curb such physical attacks over time.

- Investors and executives are complementing asset custody with personal security measures to stay safe.

Stay up to date with the latest Web3 security developments by subscribing to relevant industry newsletters and sources.