DeFi Derivatives Explained: How Layer-2 DEXs Are Racing to Beat Centralized Exchanges with Speed, Security & Self-Custody

Source: Deep Dive into DeFi Derivatives | MixBytes

Decentralized finance (DeFi) derivatives have evolved rapidly, moving from slow, costly on-chain protocols to high-performance, nearly instantaneous trading environments rivaling centralized exchanges (CEXs). This transformation increasingly enables traders to maintain control over their assets-no custody handoffs needed-while enjoying competitive speeds and liquidity.

Understanding Derivatives in Crypto

Derivatives are contracts whose value depends on an underlying asset, such as Bitcoin, Ether, or indexes. In crypto, centralized exchanges like Binance, Bybit, and OKX dominate the derivatives market, accounting for about 95% of the $3–4 trillion monthly volume.

Key derivatives used by traders include:

- Futures:

- Dated futures settle on a fixed date at a predetermined price.

- Perpetual futures (perps) never expire but charge periodic funding rates to align with spot prices, offering continuous leverage without expiration hassles.

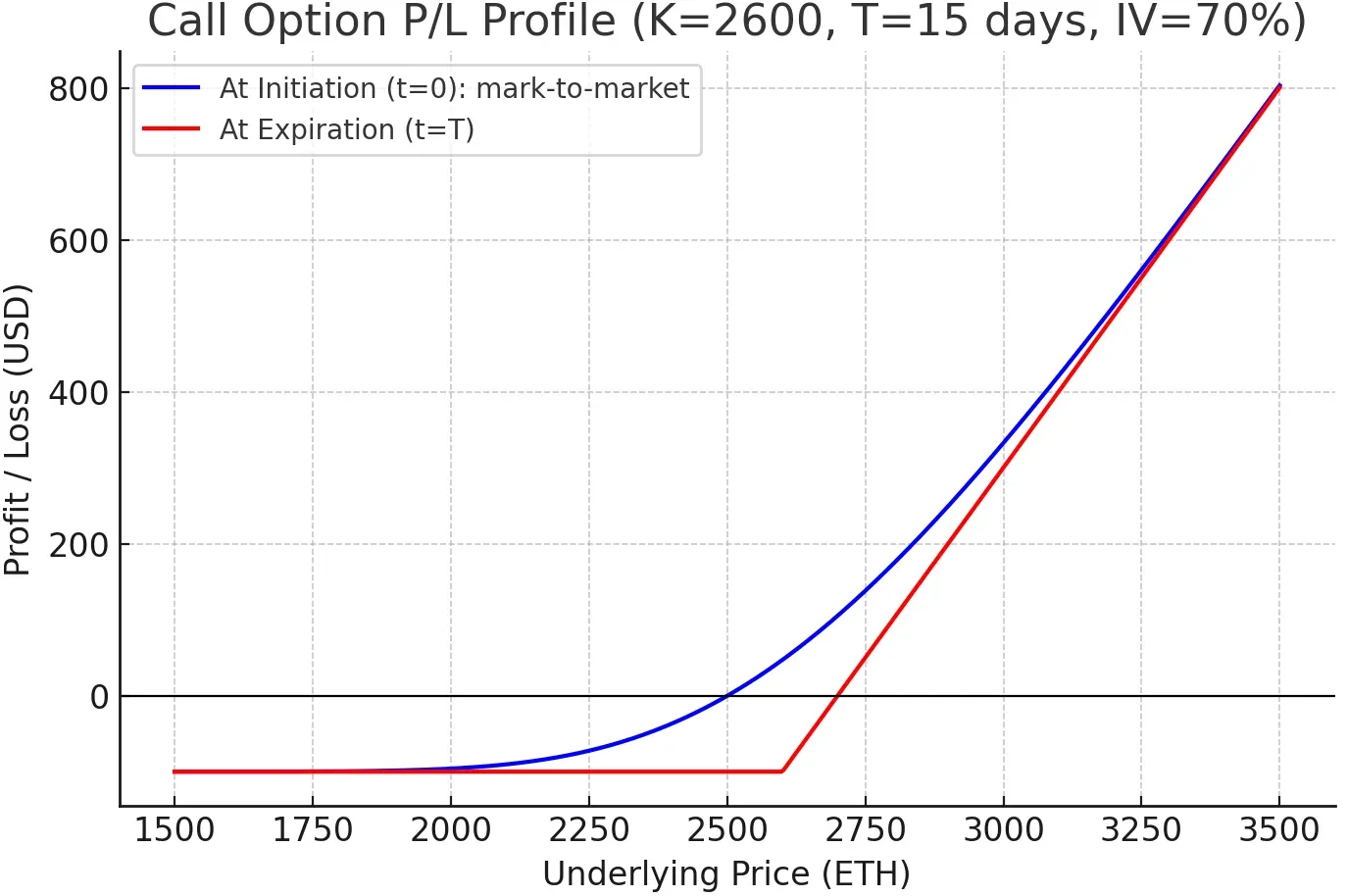

- Options: Grants the right, but not the obligation, to buy (call) or sell (put) an asset at a set strike price before expiry. Buyers pay a premium and risk only that amount; sellers earn premiums but take on unlimited risk.

Options pricing involves four main "Greeks" that govern risk:

- Delta (Δ): Sensitivity to the underlying asset’s price.

- Gamma (Γ): Speed of delta’s change.

- Vega (ν): Sensitivity to implied volatility.

- Theta (Θ): Time decay reducing option value as expiry nears.

These dynamics create complex P&L shapes, unlike the linear rake of futures.

1. Early On-Chain Derivatives (2019–2021): Promise and Pitfalls

First-generation on-chain derivatives platforms-Opyn, Hegic, Siren, Perpetual Protocol v1, dYdX v3-enabled non-custodial trading on Ethereum but struggled with:

- Slow and expensive transactions: Gas fees often soared above $20; transaction times stretched to 10-20+ seconds.

- Collateral inefficiency: Each product required separate collateral, locking large capital amounts.

- High risk to liquidity providers: AMMs suffered during volatile swings, exposing LPs to gamma risk and losses.

These issues underscored that early DeFi derivatives lacked the infrastructure to meet professional trading demands.

2. What Professional Traders Need

Traders rarely take single-direction bets; instead, they deploy sophisticated portfolios including spot holdings, futures, and options to hedge risk and optimize returns. Their key requirements from exchanges are:

- Ultra-low latency (<10 ms): Fast execution is crucial; delays erode edge in volatility trades.

- Unified collateral pools (cross-margin): One balance should margin spots, futures, and options simultaneously to maximize capital efficiency.

- Robust, transparent risk engines: The platform must reliably handle large positions, honor margin calls, and have strong safeguards against counterparty failure.

When any of these are missing, liquidity dries up quickly-as early DeFi exchanges learned the hard way.

3. Options Complexity and Risk Engines

Options pose unique engineering challenges:

- Non-linear risk: Gamma and vega cause margin demands to shift swiftly with price and volatility changes.

- Storage bloat: Thousands of strike-expiry pairs create massive on-chain state.

- Pricing computations: Full Black-Scholes models are costly on-chain, requiring off-chain pre-computation or approximations.

Settlement types:

- Dated (European-style) options settle at expiry, needing oracles and timers.

- Perpetual options (popularized by Paradex) rely on continuous funding payments but are less familiar to traders.

Margining involves complex scenario revaluation rather than single price marks, necessitating lightning-fast oracle feeds and computations.

Efficient solutions today blend:

- SPAN-style grid margining (worst-case scenario shocks), or

- Off-chain Black-Scholes calculations supplemented by on-chain proofs, or

- Statistical/Stress hybrid models balancing gas costs and accuracy.

4. The Current Landscape: Layer-2 Rollups & zk-CLOBs (2022–2024)

Modern DeFi derivatives platforms leverage innovations:

Leading Platforms Overview:

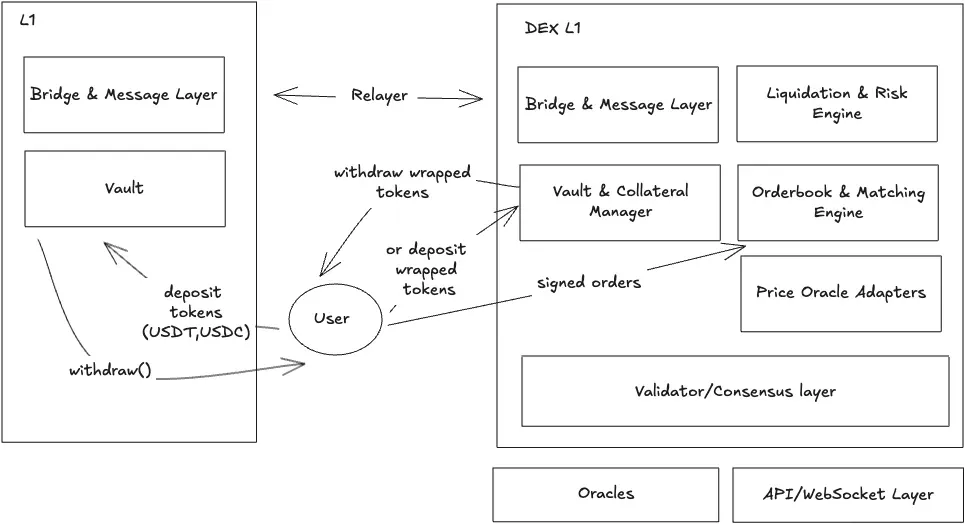

- Layer-2 rollups and custom Layer-1s batch and compress transactions, drastically slashing gas fees and latency.

- Hybrid off-chain/on-chain order matching (central limit order books run off-chain; settlement occurs on-chain to safeguard custody).

- Unified cross-margin systems pooling collateral across products.

- Zero-knowledge proofs (zk-proofs) for validity and privacy without bloating on-chain state.

| Platform | Architecture & Chain | Workflow | Latency | Security | Decentralization |

|---|---|---|---|---|---|

| Paradex | Starknet zk-rollup → Ethereum | Off-chain CLOB, on-chain batch | ~200 ms | zk-STARK proofs, audited | Single sequencer |

| Zeta / Bullet | Solana L1 → Bullet roll-up | Off-chain CLOB, on-chain margin | 2–5 ms round-trip | Solana custody, on-chain proofs | Centralized sequencer |

| Backpack | Private chain + Solana PoR | Centralized order book | <10 ms | Custodial, daily zk proofs | Fully centralized |

| Derive | OP-stack roll-up → Ethereum | Off-chain CLOB, on-chain settle | 100–200 ms | L2 custody, fraud proofs | Single sequencer, DAO |

| Syndr | Arbitrum Orbit L3 | Off-chain CLOB, on-chain SPAN | <100 ms | Arbitrum security | Single sequencer, DAO |

| Hyperliquid | Cosmos-SDK L1 (HyperBFT) | Fully on-chain CLOB | ~200 ms median | PoS validators, insurance | Permissioned validators |

| Ostium | Arbitrum One L2 | Off-chain CLOB, on-chain CFDs | ≤200 ms | Non-custodial, fraud proofs | Single sequencer, DAO |

| Lighter | zkLighter app-specific zk-rollup | Fully on-chain CLOB + zk proofs | <5 ms | Validity proofs on Ethereum | Central sequencer |

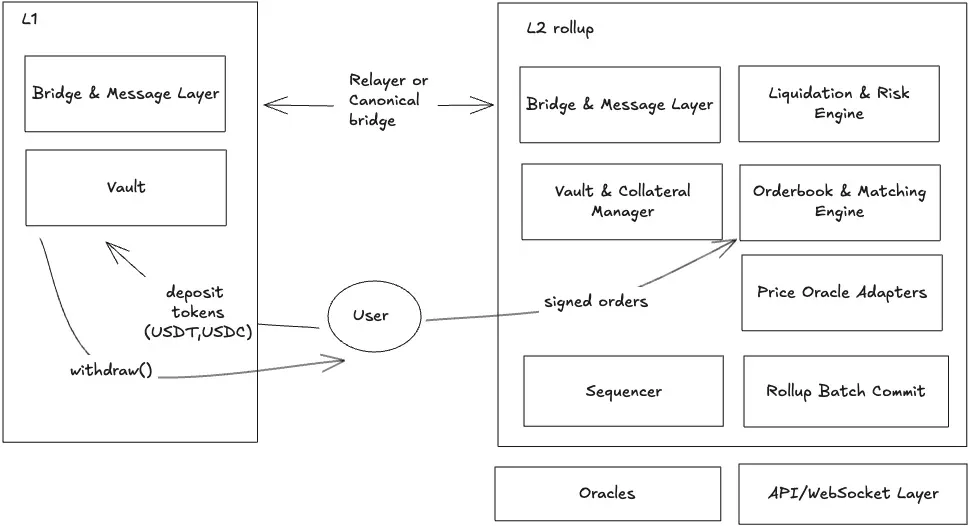

Layer-1 based DEX architecture:

Layer-2 based DEX architecture:

4.1 Performance vs Centralized Exchanges

Binance remains a lightning-fast exchange with sub-5 ms CPU trade matching and 1–10 ms round-trip times for colocated traders, capable of over a million orders per second.

Yet Lighter’s zk-rollup reaches sub-5 ms match times and sub-second finality, with throughput between 10,000–50,000 orders per second-enough for most active strategies.

Hyperliquid’s fully on-chain Cosmos solution prioritizes censorship resistance and self-custody over raw speed, handling 100,000–200,000 orders per second with ~200 ms latency.

A derivatives DEX stands out by never holding user keys: collateral remains in smart contracts controlled solely by traders, immune to freezes or censorship.

4.2 Layer-1 Throughput Limits

All rollups ultimately rely on their Layer-1 for data availability, creating throughput ceilings:

- Ethereum’s EIP-4844 offers ~0.75 MB per 12-second block (~58 kB/s usable), translating to about 1,000 compressed orders per second for rollups.

- Solana’s real transaction throughput is ~800–2,000 user tx/s, with effective payload around 140–360 kB/s.

During volatility spikes, these bandwidth limits tighten, causing congestion, higher fees, and delayed settlements. Innovations like distributed data availability layers (Celestia, EigenDA) and improved proof compression aim to raise this ceiling.

4.3 Current Bottlenecks

Challenges remain despite progress:

- On-chain state expansion: Option markets and order books rapidly increase storage, inflating gas costs and validator requirements.

- Proof latency: zk-proofs and optimistic rollups take time; delays can freeze withdrawals in volatile times.

- Sequencer centralization: Fast single sequencers risk censorship; distributed sequencing is an ongoing research area.

- Fragmented liquidity: Multiple isolated markets across chains lead to inefficient capital use.

- Fee volatility: Gas spikes can rapidly turn profitable strategies into losses.

- Risk engine limitations: Much Greek re-pricing and risk math still happens off-chain, causing operational risks.

5. Security and Real-World Risks

5.1 Hyperliquid Incident (March 12, 2025)

A wallet opened a massive $340 million ETH perpetual future at ~180× leverage, initially profitable by $8 million. Without prompt margin recalculation after a large collateral withdrawal, and lacking partial liquidation, when the position went underwater, the entire liquidation happened at a stale price, causing a $4 million loss socialized to liquidity providers. The trader pocketed $1.8 million in net profits.

In response, Hyperliquid reduced max leverage, tightened collateral rules, and added partial liquidation to reduce liquidation risk on large positions.

5.2 General Attack Vectors

- Oracle manipulation: Feeding false prices to trigger liquidations or wrong margin calls (examples: Mango Markets, dYdX flash crash, Deus Finance).

- Liquidity squeezes ("gamma traps"): Large short option volumes cause forced buying in volatile moves, bankrupting LPs.

- Insurance fund drain: Manipulating funding flows to extract from safety nets (notably dYdX in 2020).

- Portfolio margin blind spots: Delta-neutral but high gamma/vega risk positions causing sudden margin shortfalls.

- MEV sandwich attacks: Bots front-run large trades to extract value (GMX AVAX incident).

- Cross-chain bridge exploits: Collateral on one chain compromised while derivatives run on another, breaking margin assumptions (Wormhole hack).

5.3 Best Practice Mitigations

- Dynamic margin requirements that respond to gamma and vega exposures.

- Leverage tapering to reduce maximum leverage on large notional sizes.

- Partial liquidations to close large positions gradually, reducing market impact.

- Hedged insurance funds, funded by fees and protected through deep OTM options.

- Real-time circuit breakers tied to oracle deviations or funding spikes to pause risk before losses cascade.

6. The Road Ahead (2025+)

Several key advancements will shape DeFi derivatives:

- Distributed Sequencers & Shared Data Availability: Rotating leadership and multi-node sequencing backed by data layers like Celestia will increase fault tolerance and throughput.

- ZK-Friendly Risk Tables: Pre-computed Greek grids to speed zk-proof generation, making margin validation quicker and more practical.

- Account Abstraction + Multi-Party Computation (MPC): Combining smart-contract wallets with distributed custody for secure, flexible institutional accounts.

- Universal Margin Wallets: Collateralized balances encompassing all asset types and derivatives, cross-netting risk and reducing capital needs by up to 50%.

- Liquidity Sharding & Intent Layers: Abstracting orders by intent, routing trade execution seamlessly across chains/shards for combined liquidity and pricing efficiency.

These innovations promise a derivatives DEX experience close to centralized prime-brokerage: fast, capital efficient, trustless, and censorship resistant.

7. Conclusion

DeFi derivatives now nearly match centralized exchanges in speed, but their real advantage is full self-custody: traders’ collateral is never controlled by the exchange, eliminating seizure risk.

The two biggest ongoing challenges are:

- Reliable, tamper-resistant price feeds to prevent oracle attacks.

- Diverse, on-chain collateral types (like tokenized treasury bills) to improve collateral options and lower fees.

Ultimately, a DEX that secures funds via smart contracts, enforces transparent pricing, and offers flexible collateral will surpass even the fastest CEXs-because trust trumps milliseconds.