How the U.S. Uncovered $110M Crypto Laundering Tied to Human Trafficking Scams

Source: How the U.S. Traced $110M Crypto Money Laundering Cases - BlockSec

U.S. authorities recently revealed a massive $110 million crypto money laundering operation tied to human trafficking scams across Southeast Asia, exposing critical compliance weaknesses in offshore banking and digital asset ecosystems. Blockchain security firm BlockSec analyzed these cases using its MetaSleuth tracing tool, drawing important lessons for developers, projects, and regulators.

Key Enforcement Updates

- September 8, 2025: The U.S. Treasury sanctioned 19 Southeast Asian entities (9 Myanmar, 10 Cambodian) involved in forcing human trafficking victims to run crypto investment scams.

- These scams, often known as “pig butchering,” trick victims through social engineering and lure them into sending funds to fraudulent crypto schemes.

- The DoJ disclosed two major money laundering prosecutions involving virtual assets, exposing global criminal networks exploiting cross-border gaps.

Case Summaries

Case 1 – $73M Laundered via Shell Companies (May 2024)

- Defendants Daren Li (41) and Yicheng Zhang (38) charged with conspiracy in an international laundering syndicate.

- Fraud proceeds passed through U.S. shell companies and then to Deltec Bank (Bahamas) where they were converted to Tether (USDT) and transferred on-chain.

- Wallets tied to the scam received over $341 million in crypto.

- Maximum penalties include 20 years imprisonment per count.

Case 2 – $36.9M Scam; 51-Month Sentence (Sept 2025)

- Shengsheng He (39) received a sentence of 51 months and ordered to pay $26.8M restitution.

- He operated a digital asset scam from Cambodia, funneling victims' funds through a single Deltec Bank account held by Axis Digital Limited (co-owned by He).

- Victims were targeted via social media and dating apps, promised high returns, but lost millions.

- Eight co-conspirators, including Li and Zhang, pled guilty to various charges.

Deltec Bank: An Offshore Compliance Weakness

Both cases prominently feature Deltec Bank in the Bahamas as a crucial fiat-to-crypto gateway. Despite regulatory expectations, Deltec’s AML controls were insufficient, enabling large sums of illicit money to flow into virtual assets without detection.

U.S. Enforcement Takeaways

- High-level commitment from the Attorney General and multi-agency task forces actively tackling crypto-enabled crimes.

- Cross-agency global cooperation involving the Secret Service, Homeland Security, DEA, and foreign counterparts.

- Specialized prosecution teams within the National Cryptocurrency Enforcement Team (NCET) have secured 180+ convictions and recovered $350M+ since 2020.

BlockSec MetaSleuth Insights

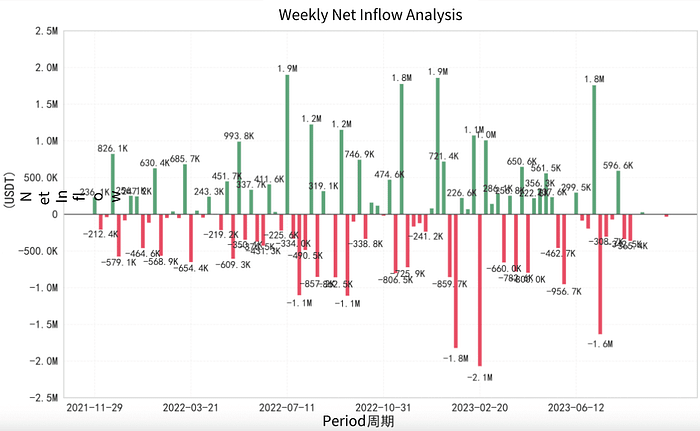

- Using AI-driven analysis, BlockSec traced wallet TRteottJGH5caJyy9qFuM8EJJGGCpDaxx6, revealing:

- Over 10,000 transfers involving 700+ counterparties.

- Total inflows/outflows around $300 million.

- Transactions linked with major exchanges (Kraken, Binance, FTX) and underground payment platforms (e.g., Huione Pay).

- Slow updates in exchange compliance and monitoring allowed illicit funds to quickly layer and obfuscate.

Recommendations for the Industry

- Enterprises should enhance AML monitoring with real-time automated screening and forensic tracing tools (e.g., Phalcon Compliance, MetaSleuth).

- Investors must be wary of unsolicited offers and keep meticulous records to support investigations.

- Regulators need to expand global cooperation, sharing illicit addresses and leveraging RegTech solutions for timely interventions.

Final Thoughts

Cryptocurrency itself is neutral, but its misuse in scams and money laundering deeply harms victims and risks the ecosystem’s integrity. Combating such threats requires a holistic approach combining advanced tracing technology, effective compliance, and heightened public awareness to strengthen Web3 security.