New Gold Protocol Drained of $2M in Flash Loan Hack — Devs Silent After Epic Security Fail

Source: rekt.news - NewGold Protocol REKT

September 17 marked a disastrous day for NewGold Protocol (NGP) on BNB Chain, as poor coding and weak security led to a devastating hack. Despite proclaiming that "security is non-negotiable," NGP’s launch turned into a textbook case of how not to build a smart contract.

How the Exploit Unfolded

- Attack Vector: A flash loan was used to manipulate PancakeSwap liquidity pool reserves.

- Core Flaws:

- The protocol trusted price oracles based solely on single DEX liquidity reserves.

- The transfer function’s broken fee mechanism allowed attackers to bypass buying limits.

- The Hack: Attackers inflated USDT reserves via flash loans, then exploited the transfer logic to purchase massive amounts of NGP tokens, circumventing max-buy restrictions. Once purchased, tokens were dumped, triggering a recursive fee sync call that destroyed the liquidity pool’s invariant and drained 444 ETH.

- Aftermath: Stolen ETH quickly moved through Tornado Cash to anonymize funds.

Code and Security Failures

- Flawed Price Oracle: Using just one liquidity pool’s reserves for pricing is a well-known risk; attackers can easily manipulate prices with flash loans.

- Broken Transfer Fees: The transfer function implemented a fee and called

sync()on the AMM pool on every sell – a catastrophic design mistake that allowed attackers to break the Automated Market Maker’s core math. - No Auditing or Controls: These vulnerabilities should have been caught quickly with basic testing and audits – yet NGP pushed faulty code live.

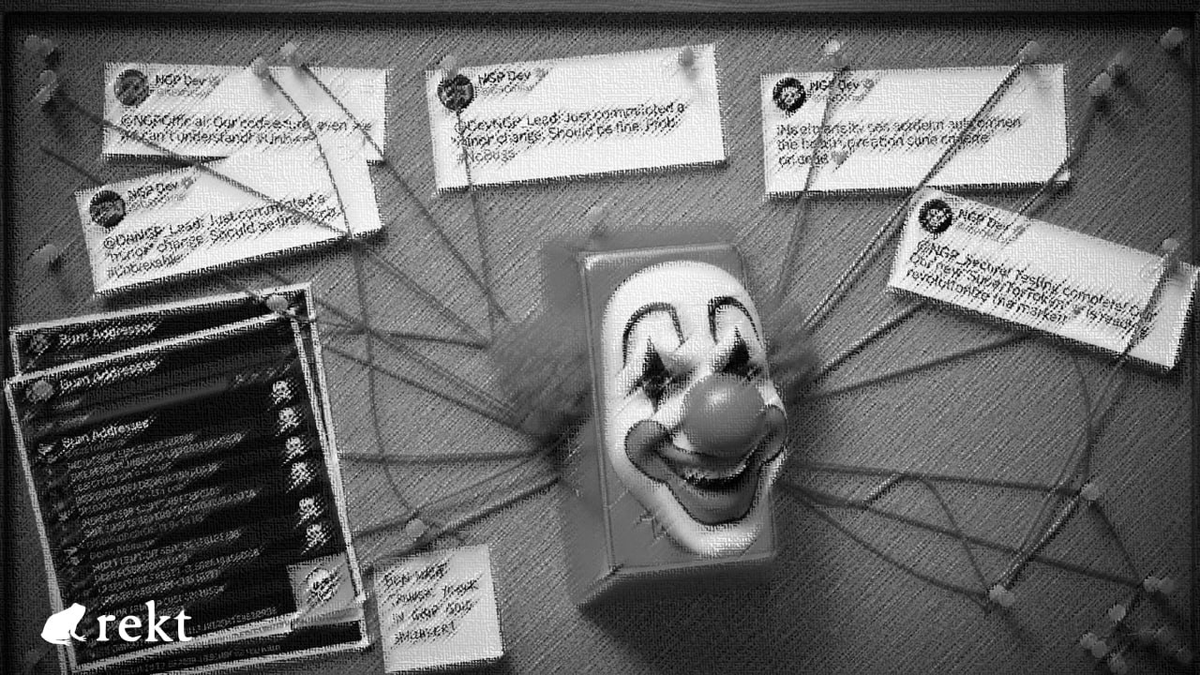

Lack of Response from NGP Team

- Silent After the Hack: Despite losing roughly $2 million, NGP has remained completely quiet since the event — no tweets, no official statements, no community updates.

- Security Promises vs. Reality: Just days earlier, the team tweeted about their commitment to security, yet showed zero accountability or crisis management once exploited.

- Community Management: The Discord and Twitter channels have seen no acknowledgment of the incident, creating a disturbing "echo chamber" where a major exploit is ignored.

The Bigger Picture

- Reckless Launch: NGP had ambitious plans involving AI-powered finance and Layer 2 integrations, but couldn’t secure basic price feeds or implement standard anti-flash-loan protections.

- Poor Documentation: Their docs were hosted on Google Drive – unprofessional and insecure for a project handling millions.

- Fast Path from Hype to Ruin: Within days of launch, the protocol became a cautionary tale showing that hype and grand promises cannot replace solid security and responsible development.

Key Takeaways for Web3 Developers and Founders

- Never rely on a single DEX liquidity pool for price oracles.

- Thoroughly audit transfer and fee logic – especially interactions with AMMs.

- Prepare a clear communication plan for security incidents before launch.

- Avoid rushed launches without proper testing and community transparency.

This incident is a stark reminder that ignoring foundational security principles can lead to rapid protocol collapse, draining user funds and trust alike.