RWA Protocol Hacks Hit $14.6M in H1 2025, Doubling Last Year’s Losses

Source: CoinTelegraph

Rising Threats to RWA Tokenization

The rapidly growing sector of real-world asset (RWA) tokenization-where tangible assets like private credit or government debt are minted as blockchain tokens-is attracting significant hacker attention. These protocols, increasingly favored by institutional investors, face growing security risks.

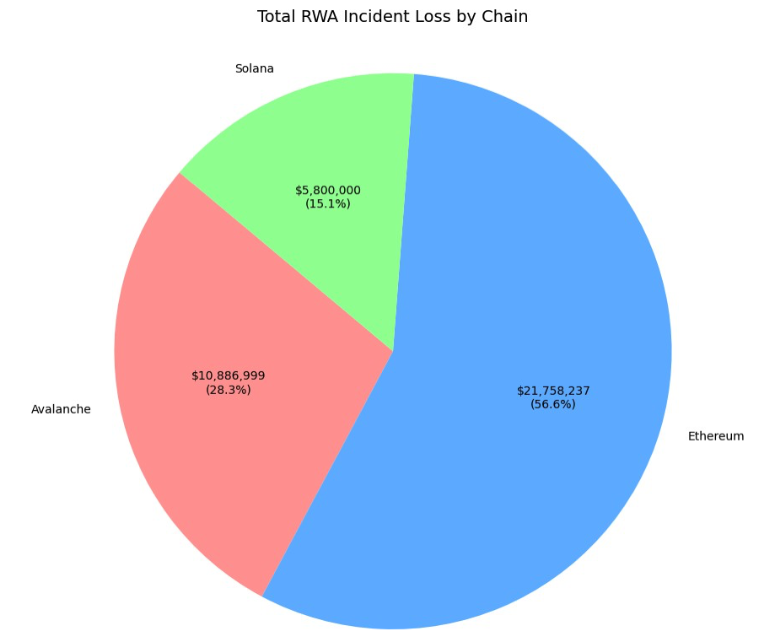

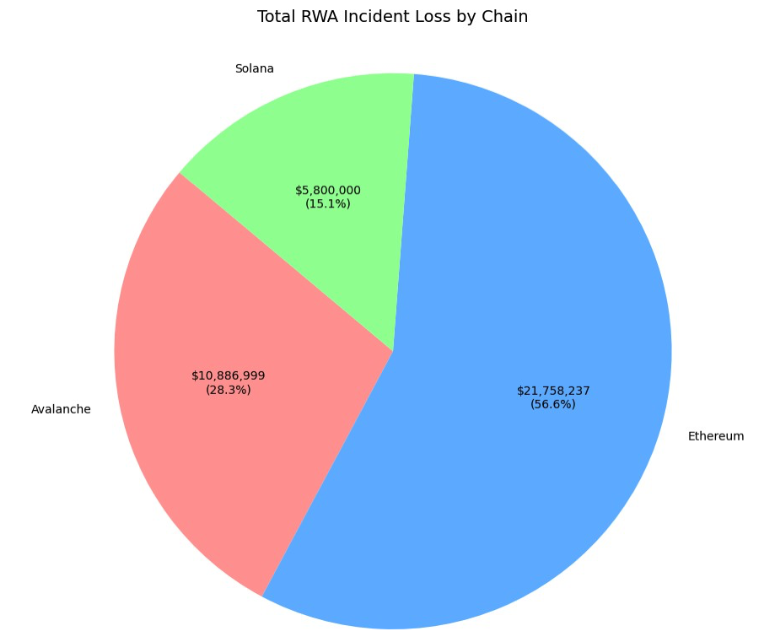

A new report by blockchain security firm CertiK reveals that losses from RWA protocol exploits reached $14.6 million in the first half of 2025. This figure more than doubles the $6 million lost in all of 2024, and is on track to surpass the $17.9 million recorded in 2023.

What’s Behind the Growing Losses?

CertiK classifies these exploits primarily as results of onchain and operational failures, marking a clear shift in the threat landscape between 2023 and 2025.

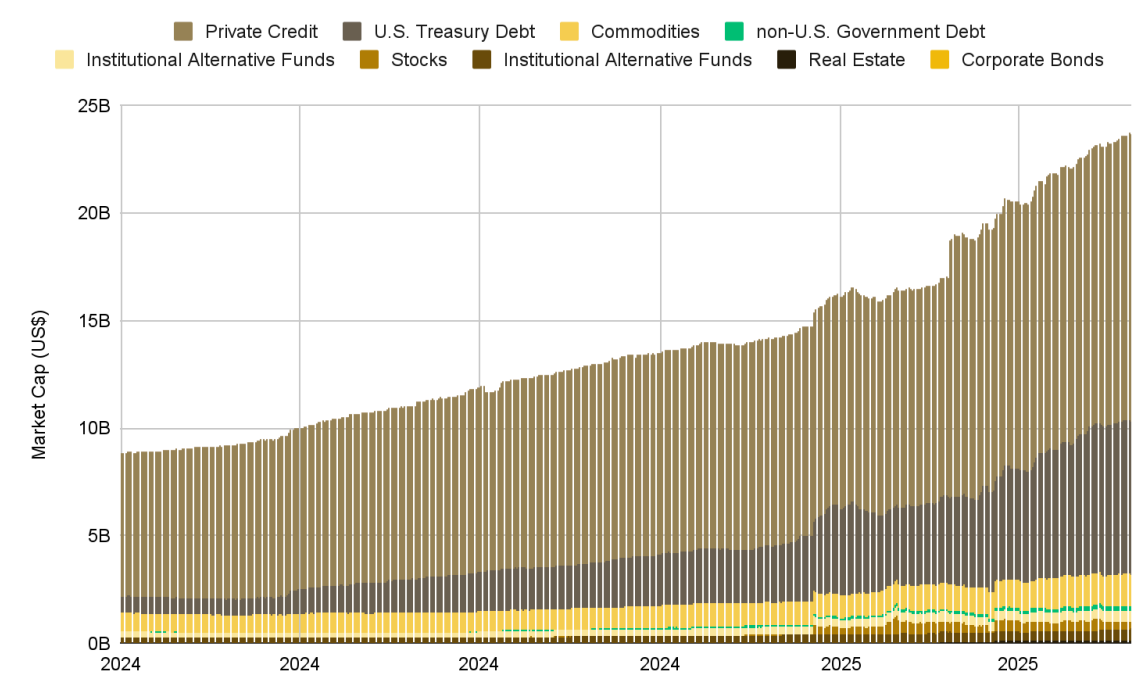

This spike in attacks coincides with a market boom: the RWA sector grew over 260% in H1 2025, reaching a valuation exceeding $23 billion by early June.

Market Breakdown & Drivers

- Tokenized private credit leads with roughly 58% market share.

- Tokenized US Treasury debt accounts for about 34%.

- Growth fueled by major players entering the space and the development of clearer regulatory frameworks, according to a Binance Research report.

Complex Security Challenges

Unlike typical crypto tokens, RWA tokens represent claims on offchain assets, creating “hybrid” security risks that span blockchain and real-world systems.

CertiK outlines a five-layer security model, each posing potential vulnerabilities:

- Oracle manipulation

- Custodial and counterparty failures

- Legal enforceability challenges

- Fraudulent proof of reserves

Notable Attacks in 2025

- Zoth, an RWA restaking protocol, suffered an $8.5 million loss in March due to a compromised private key-labelled a “classic operational failure.”

- In the same month, another attacker exploited a logic bug to mint $385,000 worth of assets without proper collateral.

- Loopscale faced a $5.8 million hack in April, caused by blockchain oracle price manipulation. The protocol impressively recovered $2.8 million of those funds within days.

With RWAs representing a critical bridge between traditional finance and DeFi, securing these complex systems is essential. Developers, founders, and researchers must remain vigilant against evolving multi-dimensional threats as the market expands rapidly.