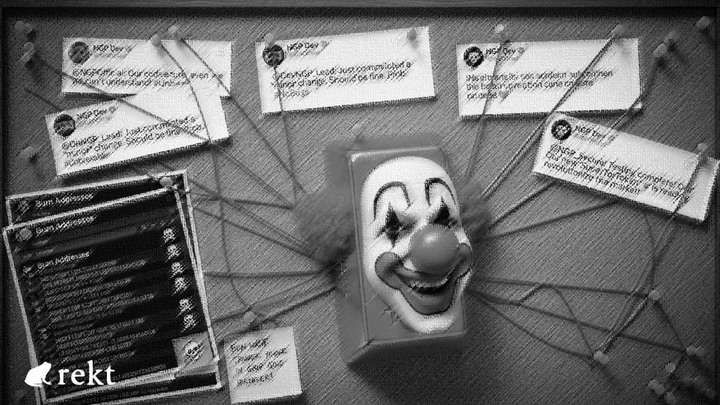

Shibarium’s $3M Heist: How Flash Loans Bought Validator Control and Broke Consensus

Source: Shibarium Rekt

On September 12, Shibarium faced a devastating blow as attackers seized 10 out of 12 validator keys, echoing the infamous Ronin Bridge hack by North Korean hackers. The exploit combined flash loans with validator control to steal roughly $3 million-not through software bugs but by manipulating Shibarium’s consensus mechanism.

The key vulnerability? Shibarium's trust model demands an honest majority of validators to maintain network integrity. When that majority becomes dishonest or compromised, the network’s security collapses.

How the Attack Worked: Hijacking Consensus

- Shibarium requires 8 out of 12 validators (two-thirds majority) to sign off on state updates.

- The attacker used a flash loan to temporarily acquire enough voting power by buying and delegating BONE tokens within the same block.

- With borrowed tokens, they signed fraudulent checkpoints that authorized the bridge to release funds.

- The flash loan was then repaid immediately using stolen assets-completing a perfectly closed exploit loop.

No smart contract bugs or protocol flaws were involved: code worked exactly as written. But the assumption that most validators would be honest proved disastrously fragile.

Impact: $3 Million Stolen, But Not All Loot Was Spendable

Stolen Assets:

- 72.6 billion SHIB (~$948K)

- 216.39 WETH (~$975K)

- 248.9 billion KNINE (~$631K)

- Plus millions more in tokens like LEASH, ROAR, TREAT, USDC, USDT, and others

However, part of the haul became useless due to token blacklisting and staking lock-ups – about $1.3 million in frozen assets. This flaw turned the attack into a costly game of digital whack-a-mole for the attacker.

Response and Aftermath: PR Spin vs. Reality

- Shiba Inu developers initially denied a hack, stating the protocol itself wasn’t compromised, focusing on the narrative rather than facts.

- Later, they admitted to damage control, uncertain if the breach originated from a server or developer machine.

- The team offered a live negotiation with the attacker, promising no prosecution if funds were returned – an unusual move highlighting their precarious position.

The Core Lesson: Decentralization or Illusion?

Only two validators refused to sign the malicious checkpoint, reportedly operating independently. This raises hard questions:

- Was the validator network centralized around a single party?

- Did governance keys or signing authorities get compromised?

If decentralization is merely theatrical, the risk of similar attacks grows exponentially. As one researcher noted, trusting validator honesty without verification is a critical vulnerability.

Final Thoughts: Trust Assumptions Must Be Reexamined

Shibarium's bridge performed exactly as designed, but that design relied heavily on validators behaving honestly. The attack exploited this trust to rewrite Shibarium’s consensus ledger-turning theft into "truth."

This incident is a stark reminder that consensus security is only as strong as its weakest majority. Without proper fraud proofs or validation checks, bridges remain attractive targets for well-planned assaults engineered through economic incentives.

Will Shibarium – and other chains – learn from this to build truly resilient, decentralized security models? Only time will tell.